Air Traffic in Latin America and the Caribbean (LAC) Grew 2.5% Year-on-Year in September

In September 2025, total passenger traffic to, from, and within the region reached 35.8 million, a 2.5% increase compared with September 2024 — equivalent to 874,000 additional passengers.

November 17, 2025

In September 2025, total passenger traffic to, from, and within the region reached 35.8 million, a 2.5% increase compared with September 2024 — equivalent to 874,000 additional passengers. Growth was entirely driven by intra-regional markets, particularly domestic operations in Brazil and Argentina, which together accounted for 87% of the net regional increase.

Flight frequencies rose 0.7% year-on-year, while total seat capacity expanded 1.8%, reflecting the use of larger aircraft, with an average of 160 seats per flight, compared to 158 a year earlier[1].

Key Indicators

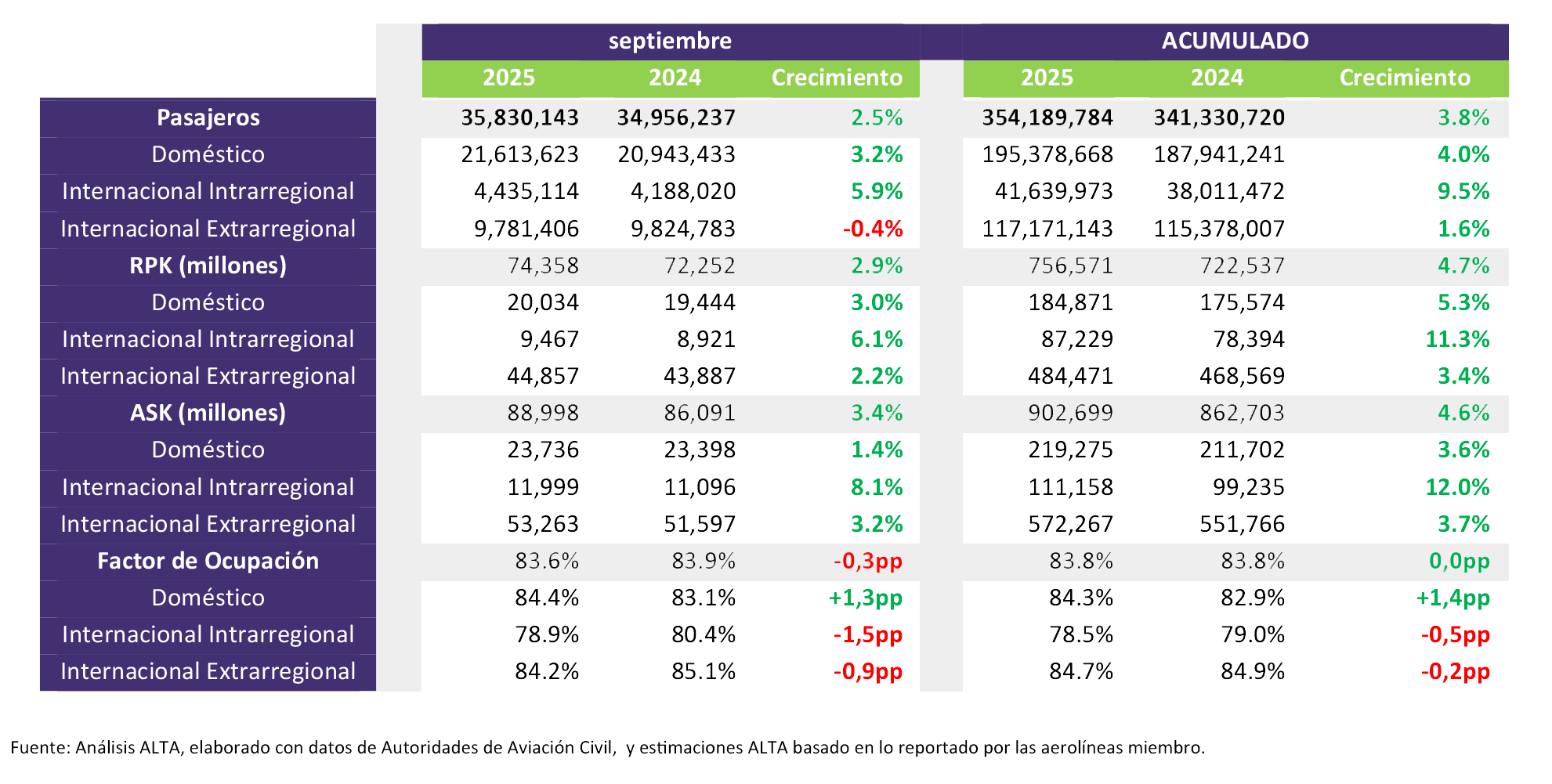

- Available Seat Kilometers (ASK) rose 3.4% year-on-year.

- Revenue Passenger Kilometers (RPK) increased 2.9%.

- The average load factor stood at 83.6%.

- Between January and September, total passenger traffic in LAC reached 354.2 million, up 3.8% versus the same period in 2024.

Brazil and Argentina Led Regional Growth

Brazil was the main driver of regional expansion in September, adding 838,000 passengers (+8.4% year-on-year). Domestic traffic reached a record high for the month with 8.5 million passengers (+7.7%), once again positioning Brazil as the fastest-growing domestic market among the world’s six largest, according to IATA[2]. International traffic surged 11.2%, supported by the arrival of 451,000 air tourists, a 26.6% increase from September 2024[3].

Argentina also recorded solid growth, with total traffic up 13.4% year-on-year (+11.7% domestic, +15.4% international). It was the busiest September in history, surpassing pre-pandemic (2019) levels by 9%. Cumulatively, Argentina handled 24.5 million passengers between January and September, a 15% annual increase.

Moderate Contraction in Mexico, Colombia, and Chile Contrasts with Strength in Brazil and Argentina

The three markets — ranked 2nd, 3rd, and 6th in the region by passenger volume — saw a combined 0.7% decline year-on-year, removing about 110,000 passengers from the regional total.

In Mexico, total traffic reached 8.5 million passengers (-0.2%), with a 1.1% increase in the domestic market offset by a 1.9% decline in international traffic. The U.S.–Mexico market, the region’s third-largest country pair, fell 3.5% year-on-year, following a mild rebound in August. Conversely, Mexico–Canada traffic — which accounts for 36% of total LAC–Canada passengers — grew 13.1%, recovering from a slight dip in August.

In Colombia, total traffic declined 0.4% year-on-year, marking the second consecutive month of contraction. Domestic traffic fell 2.4%, while international demand rose 2.4%, driven by a surge in flights to Panama (+6.5%), Peru (+14.3%), and Ecuador (+18%). Throughout the first nine months of the year, Colombia’s domestic market registered positive growth only in January (+3.5%) and July (+0.6%); in all other months it contracted, resulting in a 2% cumulative drop versus 2024. Among the 10 largest domestic routes, six showed year-on-year declines.

In Chile, September 2025 marked the second negative month of the year in total passenger traffic (–3.2%). Domestic traffic, representing 57% of the total, fell 3.3%, while international traffic recorded its first negative result of 2025, down 3.1% year-on-year.

“September’s growth was concentrated in domestic and regional routes, with Brazil leading the expansion. However, this momentum could stall if measures restricting commercial freedom advance — such as Bill No. 5,041/2025. Latin American aviation needs policies that foster competition and efficiency, not regulations that increase costs and limit passenger choice.” said Peter Cerdá, CEO of ALTA.

Panama and the Dominican Republic Drove Growth in Central America and the Caribbean

In Central America, traffic to and from the subregion grew 5.6% year-on-year, led by Panama (+9.3%, 1.72 million passengers), followed by Costa Rica (+4%) and Guatemala (+2.9%). El Salvador, the subregion’s third-largest market, saw a 5.6% year-on-year decline.

In the Caribbean, the Dominican Republic led growth with 1.22 million passengers, a 2.9% annual increase. Flights to the United States rose 10.4%, marking the fourth consecutive month of growth and the second-highest level so far this year. Jamaica remained broadly stable with 423,000 passengers, a marginal 0.3% decline%.

Glossary: RPK (Revenue Passenger Kilometers): number of paying passengers transported multiplied by the distance flown | ASK (Available Seat Kilometers): number of seats available for sale multiplied by the distance flown | Load Factor: obtained by dividing RPK by ASK.

Methodological Note

In this document, Latin America and the Caribbean (LAC) is defined as the combined total of South America, Central America, the Caribbean, and Mexico. This definition is applied consistently across all regional and international traffic analyses.

Domestic traffic refers to flights operated within the same country. International traffic is classified into two broad segments:

- Intra-regional international traffic: flights between countries within LAC (e.g., Argentina–Brazil or Mexico–Colombia).

- Extra-regional international traffic: flights between LAC and other regions of the world, such as North America, Europe, Asia-Pacific, the Middle East, or Africa.

[1] ALTA. Own analysis based on CIRIUM SRS Analyzer data, October 2025

[2] IATA, Air Passenger Market Analysis – September 2025, IATA Sustainability & Economics

[3] Embratur – Brazilian Tourism Institute. Data Panels – International Tourist Arrivals by Air. Accessed October 2025. Available at: https://embratur.com.br/para-o-trader/inteligencia-de-dados/paineis-de-dados/chegadas-internacionais/